Fredericksburg bankruptcy attorney Secrets

Therefore, consulting with a highly trained bankruptcy attorney can enormously assist in making certain that each one expected files are accurately ready.

Just after your circumstance is submitted, you build a monthly payment want to pay back your attorney's expenses commencing 30 times after the filing of one's situation. Payments can be as little as $fifty weekly.

Aside from getting the reduction of not having to dodge phone calls and hide from the creditors, you can obtain some unique benefits using a Chapter 13 filing. They don’t make filing good

Filing bankruptcy can be a authorized system. Until you know what you might be executing and possess encounter with the method, you could inadvertently make severe faults as part of your filing files.

After your Conference in the creditors, you will have to take a 2nd credit card debt counseling training course. This will let you recognize your present-day budget and how to control your debts heading forward.

A Chapter 13 bankruptcy normally stays with your credit score reviews for seven many years in the date you submitted the petition. It could possibly lessen your credit history rating by about a hundred thirty to 200 points, but the effects on the credit history diminish after some time. When you mend your credit score, it may be not easy to qualify For brand spanking new loans or other forms of credit history. There’s also force to help keep up using your a few- to five-year plan simply because lacking payments could lead to a dismissal. helpful site In that situation, you stand to get rid of any assets you had been hoping to protect. For that reason, Chapter thirteen bankruptcy ought to be utilised as A final resort. Ways to file for Chapter 13

When filing Chapter thirteen, you may have to post a proposed payment system. In the long run, the courtroom will require you to pay for the mandatory debts and get a discharge of qualified debts.

By comparison, a Chapter 13 repayment system Typically pays off all precedence creditors in comprehensive. Secured creditors get not less than about the worth on the collateral. Only Visit Website unsecured creditors may possibly end up with little or absolutely nothing.

I desired him for your chapter 13 and he was capable of rapidly take me on to be a shopper. Parisa Emiko R. Look at total evaluation listed here

ordinarily allows These with a regular profits to pay their debts over a period of a here are the findings few-to-five years, and it consolidates All those debts into 1 regular payment. It’s the legal way in order to avoid foreclosure or repossession and to start managing out-of-Management personal debt successfully.

If you are look here eligible for bankruptcy, the court docket will tackle your debts in accordance with the chapter of bankruptcy that you are requesting. If you are filing Chapter seven, the court docket may require you pop over to these guys to liquidate many of your property to pay your creditors.

Debts can normally be classified into precedence debts, secured debts, and unsecured debts. Precedence debts have Specific standing as These are thought of more important than other types of debt and can't be discharged through bankruptcy.

Let's choose a better consider the crucial documents you must deliver when filing for bankruptcy.

Circumstances that decision for an unexpected emergency bankruptcy filing could arise, and our Fredericksburg bankruptcy attorneys can help. When you are experiencing a foreclosure or wage garnishment, bankruptcy could give you the security from creditors as the Automatic Stay will come into Engage in instantly and all selection action and lawsuits must stop.

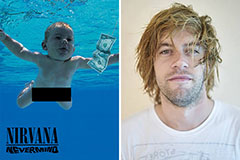

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Brandy Then & Now!

Brandy Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!